What is a Writ of Execution?

A writ of execution is a court order that authorizes a sheriff or other officer of the law to seize assets to satisfy an unpaid judgement. It allows creditors to forcibly take possession of a debtor’s property and sell it to pay off the judgement debt. Writs of execution are powerful tools used as a last resort to enforce civil court judgements.

Purpose of a Writ of Execution

The purpose of a writ of execution is straightforward – to enforce collection on an unsatisfied civil court money judgement. It gives the judgement creditor (the party who won the lawsuit) a legal method to recover what they are owed by going after assets belonging to the losing defendant.

Writs of execution serve an important role in the civil justice system by putting teeth behind court orders and judgements. They act as a strong incentive for civil judgement debtors to voluntarily pay what they owe or else risk losing their assets in an involuntary, court-ordered seizure and sale.

When is a Writ of Execution Used?

A writ of execution will typically only be sought and issued if there have been failed attempts at voluntary collection on the judgement debt. The court intends writs of execution to be a last resort after other post-judgement collection attempts are unsuccessful or inadequate.

Common situations when a judgement creditor will apply for a writ of execution include:

- The defendant ignores requests for voluntary payments on the judgement

- Attempts to garnish the defendant’s wages or bank accounts are unsuccessful

- The defendant lacks regular wages/accounts that can feasibly be garnished

- Settling for small periodic payments would take an unreasonable amount of time to pay the debt

- The defendant owns valuable non-exempt assets that can cover a large portion of the debt

So in summary – judgement creditors use writs of execution as a last ditch attempt to enforce debts that a) are large enough to warrant the process or b) show no sign of being willingly satisfied through other means.

Types of Assets a Writ of Execution Can Seize

Writs of execution can be used to seize a variety of non-exempt assets including:

- Vehicles – Cars/trucks/RVs/boats if not covered by an exemption

- Cash – Legal currency, money in bank accounts

- Investments – Stocks/bonds/securities

- Jewelry or collectables – Valuables that could be sold

- Equipment – Farm, office, medical, etc.

- Real estate – Houses, buildings, land

- License interests – Patents, copyrights, oil/gas rights

However, there are rules about which assets can and cannot be taken by a creditor armed with a writ of execution. Not all personal property is fair game…

The Writ of Execution Process

If voluntary judgements go unpaid and alternative collection methods fail, creditors can initiate the writ of execution process. Here is how it works step-by-step:

Applying for a Writ of Execution

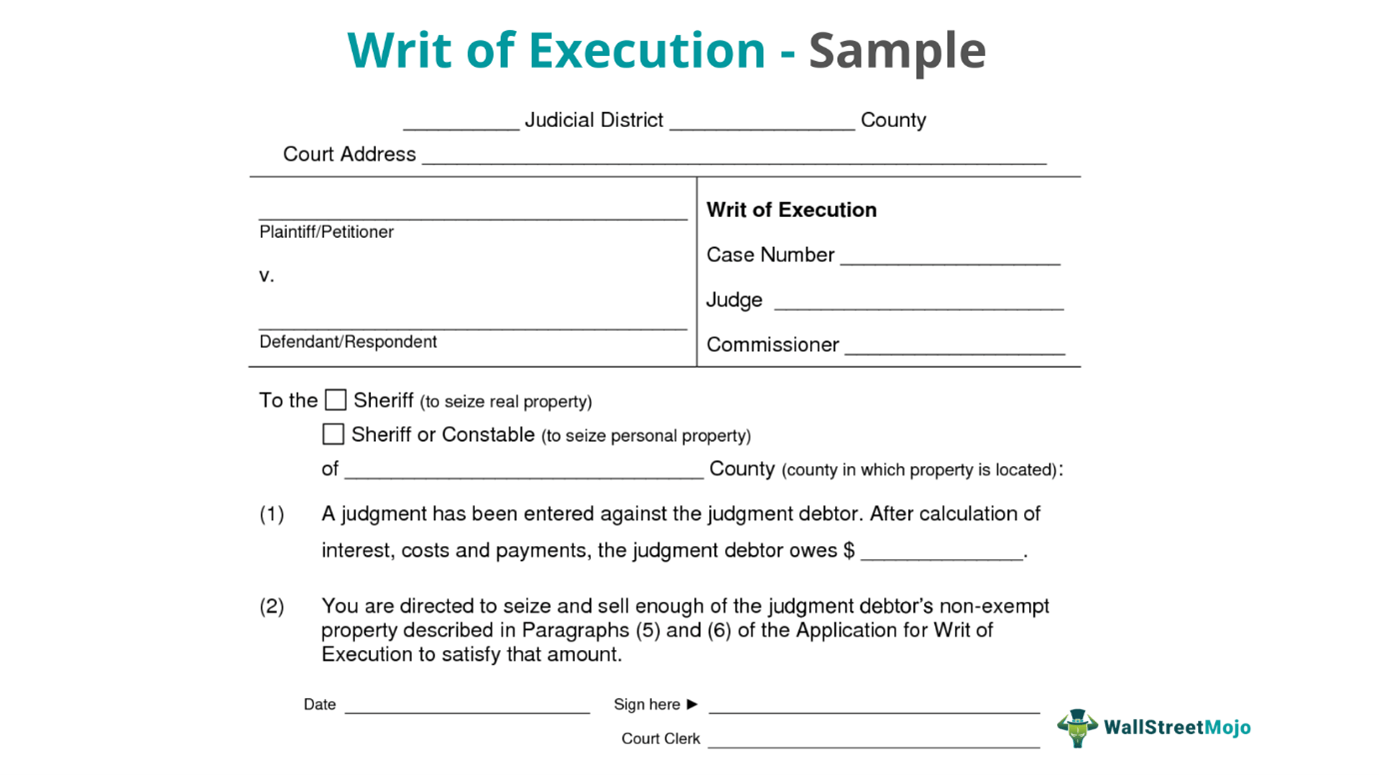

To start, the unpaid judgement creditor files an application (called praecipe) for a writ of execution with the court clerk. This application formally requests the court issue a writ against the civil judgement debtor’s assets.

Key details are required in the praecipe including:

- Name/address of judgement creditor

- Debtor name/address

- The original cause number

- Date/amount of underlying judgement

- Statement that judgement remains unsatisfied

There may also be a small filing fee required by the court clerk.

Serving the Writ of Execution

Once issued by court clerk, the writ must be properly and promptly served on the judgement debtor. Usually service is carried out by the county sheriff’s department. Manner of service can vary but must adhere to court procedural rules – typically requiring personal service or leaving it at their residence with a competent member of the household.

Actual physical seizure of assets cannot commence until after the debtor is served with the writ of execution. This gives them formal notice that a court-ordered collection is imminent if they do not satisfy the unpaid judgement or file objections. Often the treat of asset seizure spurs last minute voluntary payments.

Seizing Assets and Property

The real teeth of a writ of execution comes from involuntary seizure of the debtor’s non-exempt property. Almost immediately after serving the writ, law enforcement can move to take possession of assets to ready them for liquidation. State law dictates seizure procedures but often real estate, vehicles, equipment, cash accounts etc. are targeted first.

Seized property is appraised and readied for public auction while money accounts are slated for turnover directly to the creditor. As assets are marshalled their value is deducted from the unpaid judgement balance.

Objections to the Writ

An unhappy debtor can file formal legal objections to fight the writ after being served. However, objections must meet specific criteria centered on defects or improprieties with language of the writ itself or in the procedure. For example, if proper service rules weren’t followed or exemptions ignored or the statute of limitations has expired.

The court holds a prompt hearing on objections to determine if there are legitimate grounds. If not, seizure plans proceed. But the debtor still has other options too…

Limits and Exemptions to a Writ of Execution

There are built-in consumer protections regarding just how far a writ of execution can go in forcibly collecting judgement debts. State and federal laws carve out exemptions shielding certain assets and property from seizure – even armed with a lawful writ.

Homestead Exemption

The homestead exemption protects a person’s primary residence from forced sale by judgement creditors. States set maximum home equity values that cannot be seized and sold out from under properly claimed homesteads. This preserves housing stability and prevents displacement by blocking involuntary execution sale of primary homes.

Personal Property Exemptions

Most states also specify dollar limits or categories of personal assets exempt from writs of execution. Common personal property shielded includes:

- Vehicles below a maximum fair market dollar value

- Tools, books, appliances essential for livelihood

- Clothing, furniture, pets and other necessities

- Limited cash, savings, pensions – varies by state

- Disability assistance, child support

So a person is not completely stripped of all their possessions due to unpaid judgements. Reasonable living essentials cannot be forcibly liquidated through writs of execution in most cases.

Exempt Income Sources

Additionally, state laws isolate protected income streams that cannot be garnished to satisfy judgements. For example, most exempt from garnishment are:

- Social Security retirement and SSDI benefits

- Private and public pensions

- Child support and alimony

- Veteran’s benefits and disability

- Workers compensation benefits

So account funds originating from these common sources are also shielded from writs of execution.

How to Avoid Writs of Execution

Facing down a writ of execution can be financially devastating if substantial assets are seized and sold off against your will. Here are proactive steps judgement debtors can take to halt a writ or avoid the risks altogether:

Post-Judgement Motions

If there are legitimate reasons why the writ is unfounded or improper, file prompt post-judgement motions. For example requesting the judgement be formally vacated or requesting more time to resolve the debt voluntarily. If granted it may cancel out the need for involuntary collection before assets can be seized.

Bankruptcy

In some cases filing personal bankruptcy may halt writ enforcement or discharge the underlying judgement altogether. This is fact specific but the automatic stay triggered by bankruptcy often creates a temporary shield. Consult a bankruptcy attorney to explore if it is a viable option.

Paying the Judgement

When assets are at risk, often borrowing money, liquidating voluntarily, or negotiating a workable payment plan with the creditor beats waiting for everything to be forcibly auctioned off at fire sale prices. If possible, scrape together enough money through loans or sales to fully resolve the debt and cancel the writ.

Even paying a large percentage of the balance down could dissuade the creditor from wanting to continue enforcement. So satisfying all or part of judgement may render the writ moot.

Concerns and Issues with Writs of Execution

While writs of execution serve a legitimate legal purpose, there are problematic areas frequently targeted for reform including:

Rights Violations

Overzealous or unlawful use of writs of execution by judgement creditors and law enforcement runs risks violating debtor rights in some cases. For example, improper or coercive procedures regarding notice, timing, manner of seizure. Also concerns around disproportionate property confiscations relative to the debt amounts owed.

Excessive Property Seizures

In particular is the valid criticism against allowing seizure and forced sale of someone’s home, vehicle, or other essential property over relatively small consumer debts. In the most egregious cases “jackpot” judgements have led to shocking outcomes where mere thousands in defaulted medical bills or credit card debts have triggered officials seizing hundreds of thousands in property value.

In response, legal reform efforts increasingly push to better align exemption thresholds and restrict extreme imbalances in assets forfeited relative to underlying judgement amounts. There is growing consensus more reasonable caps and greater discretion is needed regarding scale of property subject to involuntary liquidation.

Conclusion

In summary – a writ of execution is a powerful civil law enforcement order used by creditors as a last resort to forcibly seize assets and property to satisfy unpaid money judgements. While often effective collecting on obstinate judgement debtors, writ procedures also raise issues regarding proportionality and rights violations in some cases.

Knowing how the writ of execution process works along with exemption protections is important for both creditors utilizing them to enforce civil judgements and debtors on the receiving end wanting to preserve their property and rights. With the right information and professional assistance, negative outcomes can often be avoided for those struggling with overdue debts being pursued at the most aggressive stage of the collections process.

FAQs

Can a creditor take my car with a writ of execution?

Potentially yes, unless your car is covered by an exemption. Most states protect vehicles below a certain fair market value threshold through exemption statutes. But expensive vehicles over exemption limits can be seized and sold by creditors armed with a writ of execution.

How much notice do I get before assets are seized with a writ?

You first get legal notice through formal service of the writ, then physical seizure cannot actually occur for a period of days or weeks afterwards. This gives you time to file objections, satisfy the debt, or seek exemptions before property confiscation moves forward.

What assets are exempt from writs of execution?

Common assets exempted include a portion of home equity value in a primary residence, vehicles up to a value cap, essential household goods, tools of a trade, basic clothing items, governmental and disability income sources. States specify protected categories and dollar thresholds.

Who serves writs of execution?

County sheriff departments normally handle official service of writs of execution. But in some jurisdictions other law enforcement agents or contracted private processors may deliver or carry out seizures. Service must comply with court procedural rules for it to be legally effective.

Can I go to jail if I don’t pay a judgement involving a writ of execution?

No, civil judgements and writs of execution cannot trigger jail time for non-payment like criminal fines can. If enough assets cannot be seized, typically creditors are simply out of luck collecting. The harshest repercussion is having non-exempt property forcibly sold off by legal order through the writ.