How Long Does Probate Court Take? Steps, Timeline, and Process

The Probate Timeline Explained in Simple Steps

The probate timeline is fluid and can vary based on multiple variables. Many of the steps in the probate process happen concurrently and do not always adhere to a strict protocol. Variables like the time of year can affect the probate timeline because tax returns may have to be filed to meet state and federal guidelines.

Decide to File Probate as Summary or Formal Administration (1-3 months)

A Summary Administration can be filed which is much faster than normal probate. In most states, you can only file for summary administration if the decedent has been dead for two years or if there is less than $75,000 in the estate.

Petition the Court to Open a Probate Case (1-3 months)

If a petition for probate administration must be filed, the personal representative or executor will submit a series of documents to the court in order to obtain letters of administration.

Hearing on Petition To Appoint an Executor or Administrator Of Estate(1-4 months)

In some states and/ or counties, a hearing may be required to appoint an executor, in others, the entire process is done by submitting the proposed order to the judge online.

Issue Probate Bond (3-6 months)

A probate bond is issued many times at the opening of the estate if the executor is not a surviving spouse and lives out of state.

Public Notice to Creditors Published (1 week months-2 months)

Public notice to creditors is published once the letters of administration are issued.

Take Inventory of All the Assets (1 month-6 months)

In many cases where there are liquid assets of the estate or there may be liquid assets of the estate, the personal representative will need to open a bank and/ or investment account in the name of the estate with an estate tax ID number.

Pay Federal Estate Tax and State Taxes (1 month to 12 months)

Federal estate tax must be paid within 9 months of the date of death if federal estate taxes are due.

Form 1040 Federal Income Tax(1 month to 12 months)

A form 1040 is a federal income tax and the decedent’s final income tax return must be filed April 15 unless it is extended.

Decedent’s Debts are Paid to Creditor Claims (3 months to 36 months)

A personal representative can choose to pay a debt of credit whether or not a creditor has filed a claim.

Independent Actions Outside of Probate Court (any point in time during probate)

Most claims are negotiated before they have to pursue independent action. If a claim goes through independent action it will be litigated and take up to 3 years to settle.

File for Petition of Final Distribution Of Estate (6-36 months)

After taxes have been paid, inventory is filed, creditor claims have been filed, negotiated, or otherwise settled, the estate gets distributed, and once the estate is distributed you can file for discharge as well as the date of discharge.

Completion of Probate(6-36 months)

Some counties require a hearing on the petition to close the probate process.

Closing Transcript for Probate From IRS(6-36 months)

In cases where an estate tax has been filed, a letter from the Internal Revenue Service (IRS) called a closing transcript, must be received and provided to the court in order to close the estate.

Entire Estate Settlement Timeline(6-36 months)

An estate that is not subject to a state tax generally takes between 9-12 months. For an estate that is subject to estate tax, the timeline is anywhere from 16 to 36 months, mostly based on delays from the IRS.

What Factors Affect The probate Timeline?

Closing an estate through the probate process can take two months to two years. While there is a possibility of settling a probate estate within as little as two months, the likelihood of this happening is extremely slim.

How Long Does Probate Take?

The time it takes to complete probate can vary depending on several factors, including the complexity of the estate, the number of heirs or beneficiaries, and the specific probate laws of the state where the deceased person lived.

What are the different types of probate?

Different types of probates will generally require different timelines to complete.

Formal probate:

This is the most common type of probate and is used when the deceased person left a valid will.

Informal probate:

This type of probate is used when the deceased person left a valid will, and the estate is relatively simple.

Small estate probate:

This type of probate is used when the estate is very small, typically less than $50,000.

Ancillary probate:

This type of probate is used when the deceased person owns property in another state or country.

Summary probate:

This type of probate is used when the estate is small and the deceased person did not write a will.

How Long After Probate is a Will Settled?

The time it takes to settle a will after probate can vary depending on several factors.

Why does probate take so long?

As you can plainly see, there is nothing simple or straightforward about dealing with probate. Emotions are running high, and complications are practically guaranteed. But what if you are in need of the cash value of your inheritance now? Is there a way to speed the probate process along? Having all your paperwork in order and hiring a probate lawyer are both steps that you can take to streamline the process. However, even these preventative measures against probate complications won’t guarantee when you will see a probate settlement.

The probate process involves many steps, including identifying assets, paying debts and taxes, and distributing assets to heirs. Delays can occur at each stage. Common reasons probate takes a long time include:

- Complex estates with multiple or disputed assets

- Legal contests over the validity of a will

- Challenges from heirs or creditors

- Difficulty tracking down heirs

- Tax issues that must be resolved with state and federal authorities

- Poor organization of estate records and assets by the executor

If complications arise, an estate that might normally take 6-12 months could drag out for several years. Patience is required, but an experienced probate attorney can help move things along more smoothly.

What can delay probate?

Some common things that can delay the probate timeline include:

- Contests over the validity of the will or trust

- Lawsuits against the estate by creditors or beneficiaries

- Difficulty locating heirs or beneficiaries

- Complex assets that are difficult to appraise or liquidate

- Tax issues like estate taxes or final income taxes for the deceased

- Poor record keeping that makes administering the estate difficult

- Disputes between heirs/beneficiaries over distribution of assets

- An executor or trustee who fails to diligently carry out their duties

Any litigation or dispute that arises can prolong the process by months or years in some cases. Even simple procedural mistakes by executors can delay things. Using an experienced probate/estate attorney helps avoid common pitfalls.

What Type of Assets are Involved in probate proceedings?

The most common assets that are involved in probate proceedings after someone dies include:

- Real estate property: This includes any houses, condos, land or other real property owned solely by the deceased person. If owned jointly with survivorship rights, they pass directly to the co-owner.

- Bank accounts: Accounts solely in the deceased’s name typically must pass through probate to be distributed to heirs, unless a payable-on-death beneficiary is named. Joint accounts pass directly to survivors.

- Vehicles: Any cars, boats, RVs, etc. titled only to the deceased may have to go through probate to be transferred.

- Other personal property: Things like jewelry, collectibles, artworks, furniture, and household goods owned solely by the deceased may go through probate.

- Stocks, bonds, investments: Non-retirement investment accounts held solely in the deceased’s name have to be probated for transfer.

- Life insurance: Payouts from policies owned by the deceased go to named beneficiaries and avoid probate.

Knowing what assets require probate helps in estate planning and naming beneficiaries properly where possible. Assets with no listed beneficiaries or joint owners must get probated.

The probate process serves the important function of legally transferring assets from someone who has died to their rightful heirs and beneficiaries. But no one wants it to drag out longer than necessary. Understanding the most common steps and timeline for probate provides realistic expectations. If major complications arise, the assistance of a probate attorney becomes invaluable to settle the estate effectively.

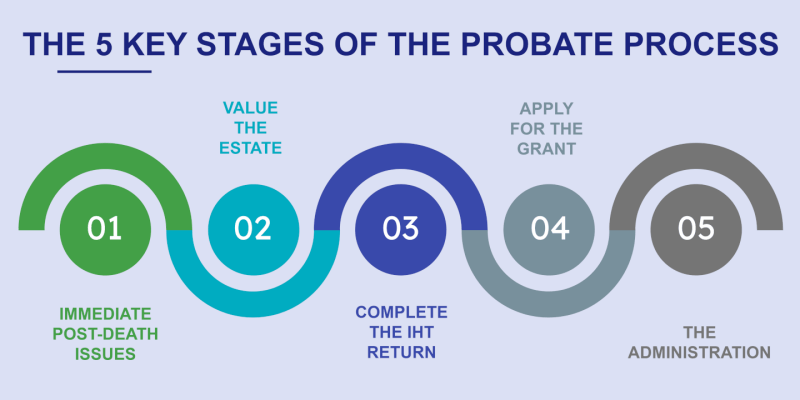

Steps Required in Probate Process

Navigating all the essential probate steps takes significant time, even in uncomplicated estates.

Some key stages that dictate minimum timeframes include:

- Initial Appointment: Getting appointed estate representative by the court

- Noticing Creditors: Allowing creditors to file claims (often 3-6 months)

- Inventory Assets: Identifying and valuing all assets (usually within 90 days)

- Pay Taxes: Filing returns and paying taxes

- Settling Claims: Communicating with creditors and settling verified debts

- Distribute Assets: Getting court approval to distribute assets to heirs

Realistically, even fast probate cases take 4-6 months at an absolute minimum to complete these processes. More often 12+ months is average.

When to Expect a Probate Completion Timeline

Given these many variables impacting probate duration, it’s impossible to know precisely how long probate will take at the start.

However, here are some general expectations based on estate size and simplicity:

- Very small estates (<$100k): 4-12+ months

- Average estates ($100k-$1M): 12-16 months

- Larger or complex estates (>$1M): 16-24+ months

- Estates with litigation or tax complications: 2-5+ years

Consult with a probate attorney to get realistic estimates for your unique situation. Act as quickly and organized as possible in providing necessary documents to keep probate moving on schedule.

While waiting through the often lengthy probate process can be frustrating, following proper legal procedures protects heirs and creditors. Patience is essential, but staying involved helps cases conclude smoothly. Reach out to your attorney anytime major delays occur to discuss options like petitioning the court.

Conclusion

In summary, the length of the probate process can vary widely depending on the size and complexity of the estate, whether there is a will, the number of heirs, any disputes, and the specific probate laws of each state. While a very simple estate could potentially complete probate in just a couple months, most take 6-12 months at a minimum, with larger, more complicated estates taking 1-3 years in some cases. Knowing the typical probate timeline and the factors that impact it can help both executors and beneficiaries set reasonable expectations.

FAQs

What is the average time for probate?

The average time for probate is 6-9 months for a typical estate according to the American Bar Association, but it can range from 2 months to 2+ years depending on size, complexity, disputes, and state laws.

How long is probate without a will?

Probate without a will often takes longer since the court must identify rightful heirs without directions from the deceased. It can add 3-6 months over the average timeline.

Can probate take 5 years?

While rare, it is possible for probate to take up to 5 years or longer if there are very complex assets, numerous disputes between heirs, or claims that must be litigated.

What is the fastest way to get through probate?

The fastest ways to get through probate are to have a will, a simple estate, cooperative heirs, an efficient executor, and to use informal or summary probate options when available under state law.

How much does probate cost?

Typical probate costs range from 3-7% of the total estate value, including attorney and executor fees, court costs, bonds, copies, filings, etc. Costs can be higher if dispute

What factors make probate take longer?

The size of the estate, complexity of assets, location of assets in multiple states, number of beneficiaries, disputes over inheritances, creditor claims, estate tax filing, and court backlogs can all make probate take longer to complete.

How can heirs speed up probate?

Heirs can help speed probate by staying organized, responsive, and cooperative to keep the legal process moving efficiently. However, proper legal guidelines control the timeline.

Why do courts control probate timelines?

Courts supervise probate to ensure all estate laws are followed properly. This protects heirs from manipulation and confusion over inheritance rights while also giving creditors fair opportunity to receive payment from assets.

If probate seems stuck, what should heirs do?

You can request status updates from the estate administrator or attorney. For significant lags between required steps, heirs can petition the court for earlier resolution.